Receive Payments File Format

How to Receive FedNow Request for Payments File Format

Receive Payments File Format – Upload Real-Time RfPs Across U.S. Banks

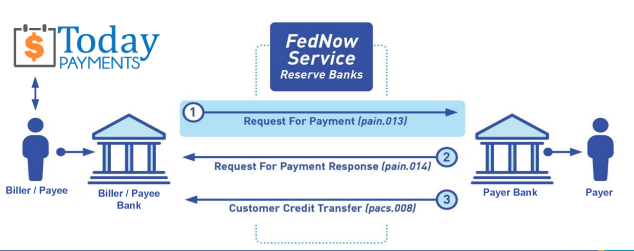

Receive Payments File Format is the new standard for businesses and payees who want to send structured Request for Payments (RfPs) using real-time payment rails like FedNow® and RTP®. Built on the international ISO 20022 messaging format, this system allows payees to upload and manage file-based RfP transactions through their secure dashboard—connected to financial institutions nationwide.

Each file includes payment details, customer aliases, and hosted links, allowing recipients to pay instantly and securely, with full reconciliation built in.

File-Based Payment Requests That Move at Real-Time Speed

Today’s payees need more than just fast payment—they need structured control, compliance, and automation. With the Receive Payments File Format, businesses can upload batched RfPs using ISO 20022, trigger payment requests via hosted links, and receive settlement in seconds.

These files can be submitted directly through a payee-facing dashboard, with every transaction routed securely through FedNow® or RTP®, depending on the receiving institution’s real-time compatibility. Each payment is associated with an alias-based Merchant Identification Number (MID), such as a mobile number or email address, allowing clean tracking and reconciliation without disclosing full financial credentials.

To receive a FedNow Request for Payments (RfP) file into your business bank account, you’ll need to understand the file format used by FedNow, how your business bank processes incoming Request for Payments, and how to review or respond to these requests. The ISO 20022 XML format is generally used for payment-related messages, including Request for Payments in the FedNow system.

Key Features of the Receive Payments File Format

ISO 20022 Structured Messaging for

Real-Time Compliance

All uploaded files conform to ISO

20022 formatting, ensuring full compatibility with FedNow® and

RTP® payment systems, as well as cross-bank interoperability.

Dashboard-Based Upload Access for Payees

Payees can upload RfP files directly through secure, cloud-based

portals—no need for manual entry or in-person visits to a

financial institution.

Alias-Based MID Tracking Across Divisions

Each RfP is linked to an alias (email or phone), enabling accurate

assignment of MIDs across business units, locations, or client

profiles.

Hosted Payment Pages Embedded in Every RfP

Each request file includes a secure hosted payment link, allowing

customers to fulfill payments instantly via desktop or mobile.

Real-Time Processing via FedNow® and RTP®

Uploaded RfPs are processed through real-time rails based on bank

compatibility, with 24/7 settlement, confirmation, and

reconciliation visibility.

Downloadable Acknowledgments and

Transaction Reports

Track settlement results and download

standardized confirmation files from the same dashboard where

uploads are managed.

Why Choose TodayPayments.com to Upload Receive Payments File Format

1. Upload RfPs formatted in ISO 20022 for

full real-time rail access

2. Process payments via

FedNow® and RTP® with full alias support

3. Assign and

manage MIDs by phone number or email address

4. Use one

dashboard to upload, monitor, and download payment data

5. Receive real-time status updates, audit logs, and

reconciliation reports

6. Eliminate the need for paper

invoicing and manual follow-ups

7. Onboard without

visiting a bank—100% online access for all payees

8.

Built for every business structure: Schedule C, LLC, S-Corp,

C-Corp, and more

Here is a detailed guide to help you receive and process a FedNow RfP file in your business banking environment:

1. Understand the FedNow Request for Payment File Format

The FedNow Request for Payment (RfP) typically follows the ISO 20022 XML format, a standardized financial messaging protocol. This XML format contains various elements that structure the payment information and ensure interoperability between different banks and financial systems.

Key elements included in an RfP file:

- Message ID: Unique identifier for the Request for Payment.

- Creditor (Receiver): The business receiving the payment request (your business).

- Debtor (Payer): The entity making the payment request (your customer).

- Amount: The amount requested.

- Due Date: The date by which the payment is requested.

- Remittance Information: Any relevant reference information or details provided by the payer.

- Payment Terms: Terms regarding late fees or penalties if the payment is not made on time.

The ISO 20022 structure ensures consistency, so your bank can easily interpret and process the payment request. Banks will typically convert this XML into a readable format for businesses.

2. Check How Your Bank Supports FedNow Requests for Payment

Each business bank may have slightly different procedures for receiving and processing FedNow Request for Payments. It's essential to understand how your particular bank handles these requests:

- FedNow Inbox/Notification Area: Some banks provide a dedicated section in their business banking dashboard where all incoming FedNow or RTP payment requests are displayed.

- Email or SMS Notifications: Banks may notify you via email or SMS when an RfP has been received.

- API Integration: If you have set up API integration with your bank, FedNow RfPs may be automatically received in your ERP or accounting system.

3. Receive the RfP in Your Bank’s Dashboard

Once your business customer sends you a FedNow RfP, the payment request will arrive in your bank’s platform, typically in real time.

Steps to Access and Review RfP in Your Bank’s Dashboard:

- Log In to Your Business Bank Account: Access your bank’s dashboard using your business credentials.

- Navigate to the FedNow or RTP Section:

- Locate the section where incoming payments and requests are managed. This may be listed under "FedNow Services," "Real-Time Payments," "Instant Payments," or "Requests for Payment."

- Look for a specific Inbox or Pending Requests tab where all incoming RfPs are listed.

- View and Review the RfP Details:

- Open the RfP to see the payment amount, payer details, due date, and remittance information.

- Ensure all details are correct before taking any further steps. Validate the request against your records if necessary.

4. Respond to the Request for Payment (RfP)

Once you receive an RfP, you can either approve and pay it or reject it if there are discrepancies.

Steps to Respond:

- Approve and Pay: If everything is

in order and you want to proceed with the payment, your bank’s

platform will typically offer a direct Pay Now button.

- Confirm the payment details, select the account you wish to pay from, and authorize the transaction.

- The payment will be processed instantly or within seconds via the FedNow system.

- Reject the Request: If the RfP

contains incorrect information (e.g., wrong amount or wrong

payer), you can reject the payment request. This option

is usually available alongside the payment option in the

dashboard.

- You may need to provide a reason for the rejection, which will be sent back to the payer for review.

5. Track and Monitor Payment Status

After responding to the RfP, you can track the payment status directly within your bank’s platform.

- Transaction History: The payment will be logged in your Transaction History or Payment Summary, showing that the request was either accepted and paid or rejected.

- Real-Time Updates: If your bank supports real-time tracking, you can monitor the status of the payment as it moves through the FedNow or RTP system.

6. Save or Export RfP for Recordkeeping

Most banks provide an option to download or export the details of the RfP for recordkeeping purposes.

- You can export the payment details as a PDF, Excel, or CSV file depending on the options provided by your bank.

- This is useful for accounting, reconciliation, and auditing purposes.

Key Considerations:

- Ensure Bank Support: Verify with your bank that they fully support receiving FedNow RfPs and ask about any specific procedures or guidelines they may have.

- System Integration: If you use ERP or accounting software, check if your bank offers an API integration that will allow you to receive and respond to RfPs directly in your software environment.

- Transaction Limits: Some banks may have transaction limits for RTP or FedNow payments, so ensure the RfP falls within these limits.

Conclusion

To receive a FedNow Request for Payment (RfP) file into your business bank account, you must understand the ISO 20022 XML format, know how your bank presents and processes these files, and be ready to review or respond promptly. By following the steps above, you can effectively manage FedNow RfPs within your business bank’s platform, ensuring real-time payment processing and better cash flow management for your business.

Request. Reconcile. All in Real Time at TodayPayments.com

Ready to receive payments faster—and smarter?

✅ Upload structured ISO 20022

RfP files from your payee dashboard

✅ Send instant

payment requests processed by FedNow® and RTP®

✅ Assign alias-based MIDs for every client,

department, or location

✅ Embed hosted payment

links in every RfP

✅ Eliminate aging receivables

with instant tracking and reporting

✅ Apply online

and start uploading today—no bank visit needed

Get started now at

https://www.TodayPayments.com

Receive Payments File

Format – Built for Real-Time, Powered by ISO 20022.

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory data for completed file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. If Merchants has created an existing A/R file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee, Additional Payment Method on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Payer Routing Transit and Deposit Account Number is NOT required to import with your bank. We add your URI for each separate Payer transaction.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Activation Dynamic RfP Aging and Bank Reconciliation worksheets - only $49 annually

1. Worksheet Automatically Aging for Requests for Payments and Explanations

- Worksheet to determine "Reasons and Rejects Coding" readying for re-sent Payers.

- Use our solution yourself. Stop paying accountant's over $50 an hour. So EASY to USE.

- No "Color Cells to Match Transactions" (You're currently doing this. You won't coloring with our solution).

- One-Sheet for Aging Request for Payments

(Merge, Match and Clear over 100,000 transactions in less than 5 minutes!)

- Batch deposits displaying Bank Statements are not used anymore. Real-time Payments are displayed "by transaction".

- Make sure your Bank displaying "Daily FedNow and Real-time Payments" reporting for "Funds Sent and Received". (These banks have Great Reporting.)

Contact Us for Request For Payment payment processing